SUM Experts Analyse Three Economic Development Scenarios for Russia

Experts from the SUM Research Institute of Digital Economy Transformation Management have prepared an analysis based on the Monetary Policy Guidelines for 2020 and 2021–2022 published by the Central Bank of Russia.

In this document, the Central Bank of Russia provides an overview of three potential scenarios for the country’s mid-term economic development:

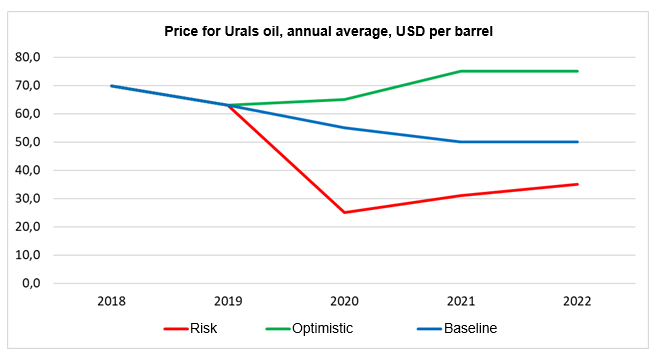

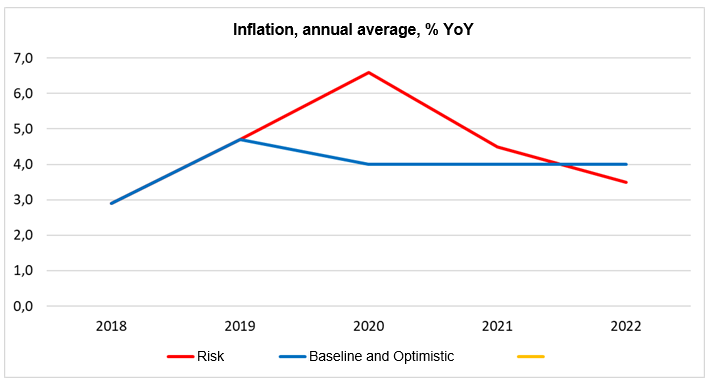

- The baseline scenario presumes a general slowdown in the growth of the global economy and a fall in the price of Urals oil to $50 per barrel by 2021. Under the baseline scenario, the Central Bank of Russia forecasts an annual inflation rate of 4.0% and GDP growth rate of 1.5–2%.

- The optimistic scenario assumes high rates of global economic development accompanied by an increased demand for energy resources, which may go up in price to reach $75 per barrel by 2021. In this case, the inflation rate is expected to also be at around 4%, while GDP growth rate may be as high as 2–3%.

- The risk scenario assumes a rapid and significant fall in oil prices down to $25 in 2020, with a subsequent gradual increase to $35 by 2022. Under this scenario, the Central Bank of Russia forecasts a spike in inflation up to 6.5–6.7%, with a 1.5-2% fall in GDP, which will subsequently return to its normal level.

SUM experts point out that the baseline scenario is currently used to make all decisions with regards to the national monetary policy.

(chart prepared by the authors based on data from the Central Bank of Russia)

(chart prepared by the authors based on data from the Central Bank of Russia)

The target inflation level for the projection period is set significantly lower than the expected 2019 figure.

The Central Bank of Russia expects inflation to be 4.6–4.8% for 2019, but the target is set at 4%. This is evidently the reason why the target inflation is the same for the baseline and optimistic scenarios: this value is more realistic for the optimistic scenario, while the baseline scenario will require keeping inflation levels within the limits of substantial regulatory actions.

This suggests that the Central Bank of Russia is not likely to reduce the key interest rate. The current key interest rate of 7.0% becomes 3% per annum given the inflation target, which does not leave the financial regulator enough room to manoeuvre.

Therefore, we can expect the key interest rate to fall by no more than 0.5%, while any deviation from the baseline scenario may lead to a decision on its proportional increase.

(chart prepared by the authors based on data from the Central Bank of Russia)

(chart prepared by the authors based on data from the Central Bank of Russia)

Дата публикации: 25.09.2019

Дата публикации: 25.09.2019